As the World Health Organization on Friday upgraded its global risk assessment for the coronavirus to “very high”, anxious oil markets are wondering when might be a good time to panic about the oil demand and its effect on inventories, investment dollars, and ultimately, oil prices.

Where We Stand

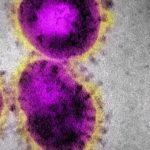

So far, the coronavirus has infected more than 80,000 people worldwide, claiming nearly 3,000 lives. It has spread to 49 different countries in just a few short weeks, and continues to disrupt airline travel on a massive scale. In California, one possible case of community transmission reared its head—bringing awareness of what the virus can do to a whole new level.

And make no mistake, there is more pain coming.

Already, COVID-19 is disrupting manufacturing and industrial output, specifically in China, and the FDA said this week that the world is experiencing its first drug shortage from these coronavirus-induced manufacturing disruptions.

China’s massive oil refiners have felt the pain too, scaling back their petroleum products output, resulting in a big gaping hole in the demand side of the now precarious supply and demand equation for crude oil. Some suggest that China’s fuel demand now has a 4-million-barrel-per-day hole, and China’s imports of crude oil is expected to have dropped by 160,000 bpd in February. March may be worse, if Saudi’s oil exports to China next month are any indication.

This decreased fuel demand has caused at least one trading arm of independent Chinese refiner Tianhong Chemical Co to go into receivership this week after feeling the coronavirus pinch. While this is just a single instance of an oil trader going under due unfavorable market conditions courtesy of COVID-19, the development is cause for alarm. Is this just the first of many in China’s independent oil arena to go under?

Related: The Perfect Storm Sends Natural Gas Crashing

This would spell disaster for China, and be painful for any of China’s many crude oil suppliers. After all, it is these independent refiners—the teapots—that have driven most of China’s oil import growth in recent years. Crude suppliers that would feel the pain of China’s refining industry meltdown would naturally be Russia, Saudi Arabia, Angola, and Iraq—who together represented 55% of all China’s crude oil imports as of 2018.

Saudi Arabia, for example, typically ships between 1.8 million bpd and 2 million bpd, but already for March the Kingdom is cutting its oil exports to China by 500,000 bpd as refineries are throttling output.

But smaller suppliers, too, would be hit, particularly countries that ship most of their oil to China—countries like Iran, for example, which ships 50-70% of its oil to China.

Where We’re Headed

So things are bad, but surely the virus has run its course?

Nothing could be further from the truth. US health officials warned Americans this week to roll up their sleeves, pull up their bootstraps and settle in, because the coronavirus is on its way.

“It’s not so much a question of if this will happen anymore but rather more of a question of exactly when this will happen,” Nancy Messonnier, director of the National center for Immunization and Respiratory Diseases said in a press briefing this week.

And if you want a preview of what’s to come, you only need to look at how major institutions such as the federal reserve are behaving.

The Federal Reserve and other central banks are expected to act soon—as early as this weekend—to staunch the market bleeding in the financial markets. The Fed’s have suggested that they will indeed cut rates “if” a global pandemic were to develop.

Related: This Country Is A Safehaven In An Unstable Middle East

About that “if” scenario, Moody’s Analytics yesterday suggested that the risk of the current coronavirus outbreak turning into a pandemic has actually doubled from 20% to 40%, calling their previous assumptions that COVID-19 would be contained to China as “optimistic”.

This pandemic, Moody’s said, would result in a global recession during H1 2020.

““The economy was already fragile before the outbreak and vulnerable to anything that did not stick to script. COVID-19 is way off script,” Moody’s said.

And Moody’s isn’t the only one who is rethinking their former optimism about the deadly virus.

The IMF is likely to downgrade its global growth projections due to the virus, according to an IMF spokesperson on Thursday. And no doubt, because lethal viruses tend to scare people away from mingling among the potentially sick at places such as malls and other public areas—a situation that naturally lends itself to serious stifling of economic activity. And all that economic stifling will have a profound effect on industry, and industry in turn will have an effect on oil demand.

The IMF is now warning that there is the potential for greater economic fallout, and it is cutting its forecast for 2020 global growth by 0.1%.

Rystad, too, stepped into the doom-spreader game on Friday, warning that the virus outbreak could cut oil and gas industry investments by $30 billion and could delay oil platform deliveries slated for Asia by three to six months. Those hit hardest would likely be shale operators in the US, and offshore E&P companies, according to Rystad.

Rystad doesn’t see the situation on the road to improvement. In fact, it sees the situation worsening in March, and affecting the entire global service industry.

Overall, travel restrictions, reduced industrial throughput, people staying home because they’re scared—these factors have not peaked, and when they do, they will dent oil demand even further. Already WTI has sunk below $45, with Brent below $50. And OPEC may lack the fortitude to cut enough production to offset the major demand losses.

It’s not out of the realm of possibility to suggest that more pain is on its way to the oil industry in the months that follow. The only question is, how painful will it be.