Despite fears of a second wave of COVID-19, oil markets rebounded last week, showing signs of improving fundamentals as global supplies continue to tighten. On Friday, Brent closed at $42.19, up by 8.20 percent w/w, while WTI closed at $39.75, up by 9.03 percent w/w. Furthermore, the 1-2 month Brent spread flipped into backwardation for the first time since the third of…

Read MoreMonth: June 2020

UAE Oil Major Signs A $20 Billion Gas Deal

UAE’s ADNOC today announced a $20.7-billion deal with six international companies for the acquisition of a minority stake in Adnoc Gas Pipeline Assets. Under the terms of the deal, Global Infrastructure Partners, Brookfield Asset Management, Singapore’s sovereign wealth fund, the Ontario Teachers’ Pension Plan Board, Snam, and NH Investment and Securities will acquire a 49-percent interest in ADNOC Gas Pipeline Assets, a…

Read MorePTI govt committed to Karachi water project: Umar

ISLAMABAD: Planning Minister Asad Umar on Monday said the federal government fully stands by its commitments relating to the ‘Greater Karachi Water Supply Project (K-IV)’. Responding to the Sindh chief minister’s statement regarding ‘wrapping up’ of the project, he said the Centre had been regularly following up with the provincial government to move the project forward, however, the authority concerned…

Read MorePetroleum Division seeks incentives for LPG import

The Cabinet Committee on Energy (CCOE) on Saturday constituted a high-level committee that would review a set of incentives for the import of liquefied petroleum gas (LPG) by public sector companies in a bid to provide the fuel to remote and hilly areas. The Petroleum Division presented the incentives to the cabinet committee, in a meeting held on Saturday and…

Read MorePakistan Underutilises Saudi oil facility

Pakistan could utilise less than $900 million worth of Saudi oil and gas credit facility on deferred payments in this fiscal year against the sanctioned annual limit of $3.2 billion – a lifeline that Prime Minister Imran Khan had secured by going twice to the Kingdom. The underutilisation of the facility has put some additional burden on official foreign exchange…

Read MoreWhat’s Next For Big Oil?

Something unthinkable is happening in Big Oil, and it’s not the demand slump or the spending cuts or the layoffs. With the exception of the demand slump, we’ve seen all this before–more than once, in fact. No, what’s unthinkable is that Big Oil appears to be planning to stop being Big Oil. It’s not a joke. Three of the world’s biggest…

Read MorePakistan petrol prices likely to increase from July 1

Petroleum products are likely to become more expensive in Pakistan from July 1 following a rise in the price of crude oil in the global market. The price of crude oil, which was $20 per barrel in the world market two months ago, has risen to $41.18 per barrel, showing an over 100% increase in the commodity’s price. The international…

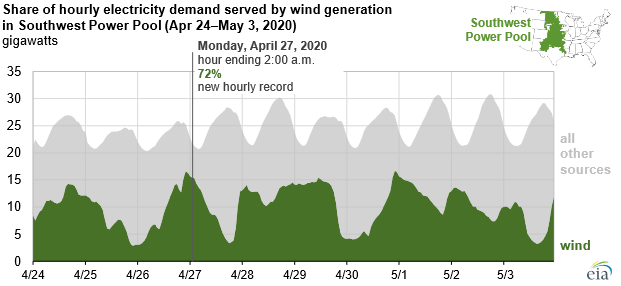

Read MoreCentral USA Set Several Wind Power Records In Spring

Originally published on the website of the U.S. Energy Information Administration.Principal contributors: Chris Namovicz, Richard Bowers Earlier this year, the Southwest Power Pool (SPP), the regional transmission organization that manages the electric grid for much of the central United States, set records for the highest share of electricity demand supplied by wind power in both a single-hour period (72%) and a full day (62%).…

Read MoreCOVID-19 Could Cause A Boom In Coal Power

The global energy industry downturn at the hands of Covid-19 has not only hurt immediate revenues, but is also affecting national infrastructure and energy policy planning. A Rystad Energy analysis shows that gas resources around the world will see development delays, with the construction of planned regasification facilities also at risk. Coal may benefit as a result. The case of…

Read MoreNo New Uplift Schemes for Karachi Get Little Attention in Sindh’s Budget for 2020-21

No New Uplift Schemes for Karachi Get Little Attention in Sindh’s Budget for 2020-21

Read More