ISLAMABAD: The Oil and Gas Regulatory Authority (Ogra) has appointed an independent third-party inspector for conducting testing of gas meters of industrial and commercial gas consumers to address consumer complaints of overbilling and one-sided fines. “It is circulated for information of industrial and commercial consumers of natural gas/ RLNG that the authority in pursuance of Clause 8.2 of Natural Gas…

Read MoreMonth: April 2021

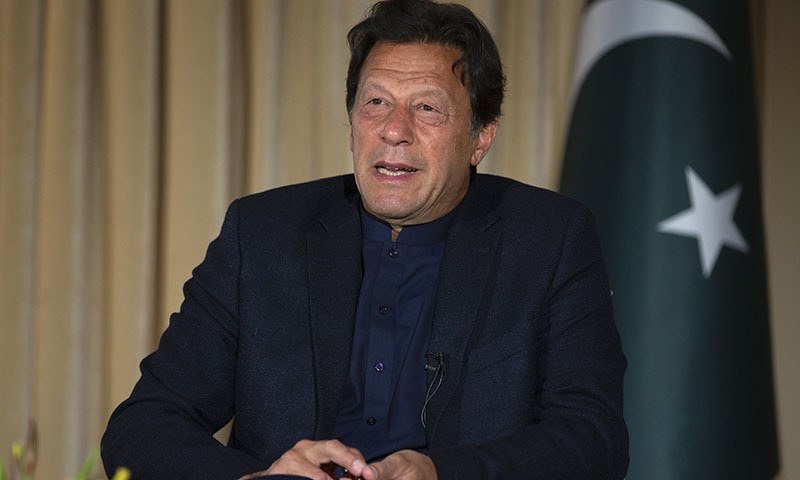

PM asks for formula to retire circular debt

ISLAMABAD: Prime Minister Imran Khan on Tuesday asked the finance and power ministries to sit together and devise a formula to retire the mammoth Rs900 billion circular debt in the power sector without putting any additional burden on electricity consumers. Presiding over a cabinet meeting, the prime minister expressed the fear that circular debt might go up to Rs1.5 trillion…

Read MoreLNG industry rebounding from pandemic

Industry analysts were raising concerns about a glut of liquefied natural gas coming onto global markets when the coronavirus pandemic hit in early 2020. As national economies shut down and energy demand plummeted, the future of the industry and multibillion-dollar LNG export terminals along the Gulf Coast looked grim. A year later, however, LNG has bounced back, recovering faster than…

Read MorePhilippines approves Vires Energy’s application for integrated LNG project

GlobalData’s free bi-weekly Covid-19 report on the latest information your industry needs to know. The Department of Energy (DOE) in the Philippines has approved Vires Energy’s (VEC) notice to proceed (NTP) application for the proposed integrated LNG project in the province of Batangas. The proposal includes the construction of a liquefied natural gas (LNG) storage and regasification terminal project. Philippines…

Read MoreCircular debt to remain over Rs1.1tr by 2023

Documents seen by Dawn suggest that a combination of ambitious policy actions will rein in circular debt growth to the extent of over Rs2tr in two years. The average tariff is projected to be Rs20.25 per unit by FY2023 from a little over Rs15.4 per unit at present. The plan envisages that there will be no additional coal-based power plant in the…

Read MorePakistan loses $5b potential Qatari investment: Investment in RLNG plants, other sectors diverted to Bangladesh

Lacklustre bureaucratic approach and inconsistent policies have resulted in losing $5 billion committed investment from Qatar in RLNG power plants, refurbishment of airports and hotels here in Pakistan and now it has been diverted to Bangladesh. Now Qatar’s Nebras Power Investment (QEWS QD) has acquired equity stake in Bangladesh’s Unique Meghnaghat Power. Also, the Nebras Power Investment Management has signed…

Read MoreWhy review of energy sector woes should go beyond existing PPAs

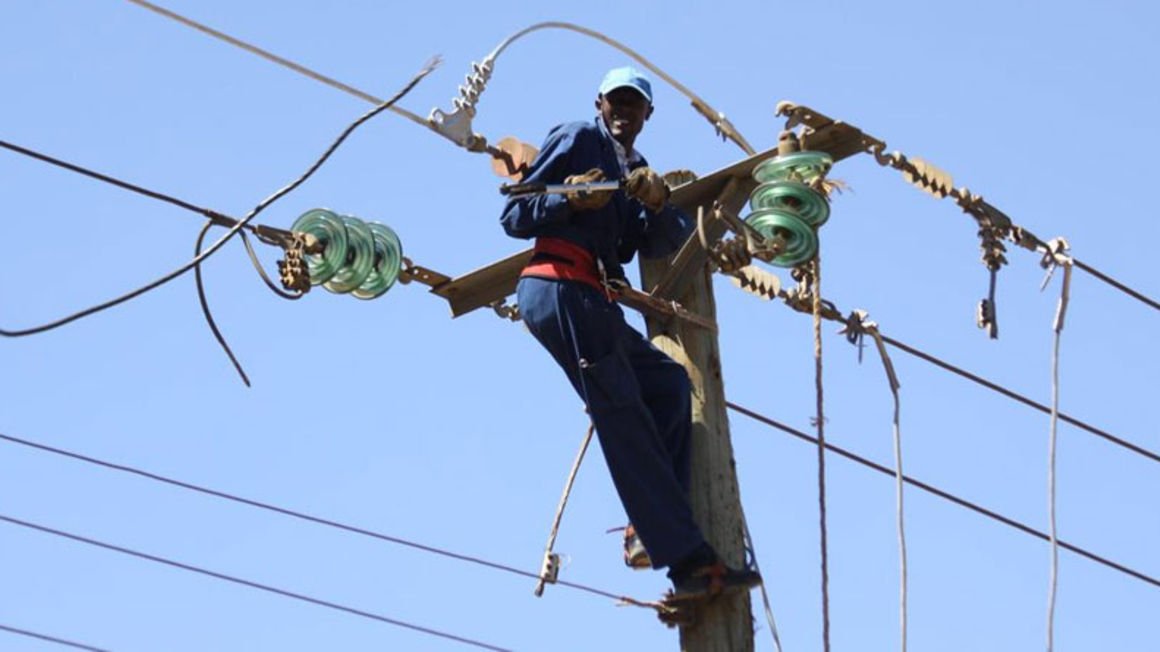

Studies have been conducted in various countries around the world, notable of which was in Sri Lanka and Pakistan in the 1990s on the economic loss of unsupplied electricity. It was found that every kilowatt (kW) that was not supplied had an economic cost of at least $1/Kwh — Sh108 — and resulted in major dips in the gross domestic…

Read MorePakistan awards exploration acreage

Pakistan has awarded six onshore exploration blocks in Sindh, Balochistan and Punjab provinces with the acreage being snapped up by local state-owned companies. Read more: Pakistan seeks $5 billion investment to spark oil and gas activityPartners (OGDC) and Mari Petroleum were awarded blocks 3068-6 (Killa Saifullah) and 3067-7 (Sharan) in Balochistan; Block 3069-9 (Suleiman) in Balochistan was picked up by…

Read MoreDefining moment for refining sector

The refining sector was facing problems even before the pandemic, recall my article two years ago, “Stringent condition: new regulation requires refineries to modernise”, where I highlighted a crisis-like situation for refineries in Pakistan post-IMO 2020 era. Lo and behold, the exogenous event of Covid-19 pandemic has now posed an existential threat to the already fragile and outdated refining sector in Pakistan.…

Read MoreTotal’s Force Majeure declaration on Mozambique LNG came prematurely, African Energy Chamber says

The African Energy Chamber is disappointed about Total’s decision to declare force majeure on its Mozambique LNG Project. While the chamber stands in solidarity with Mozambique and Total and all energy investors, we believe the declaration of force majeure could have been prevented and comes prematurely. We encourage all parties involved to have a better and more open conversation to…

Read More