A decade of underinvestment in traditional energy supply chains has finally caught up to world economies. Surging demand, tightening inventories and soaring prices are causing energy shortages and blackouts. Coal and natural gas inventories are at dangerously low levels, diesel power generation is switching on, factories are shutting down, and blackouts are already happening in China.

The situation has deteriorated materially since “The Myth of OPEC+ Spare Capacity” was published, yet the consensus remains that OPEC+ can tame oil markets at any time by unleashing its abundant spare capacity. In this context, it is timely to provide more insight into OPEC+’s spare capacity shortfall relative to consensus, to share our estimation methodology and to highlight recent developments that support our findings.

A Primer On The Global Energy Crisis

The global energy situation is increasingly dire. Limited natural gas exports from Russia have pushed European prices to all-time highs, with the U.K. and other European alternative energy power generation disappointing and proving unreliable. Shortages of thermal coal and liquefied natural gas (LNG) are forcing major Asian economies to shut down power plants and blackout cities. Additionally, soaring oil prices are exacerbating inflationary pressures across supply chains and reducing affordability of already inefficient diesel power generation. A cold winter could aggravate the situation, and low global inventories of natural gas and coal increase the risk.

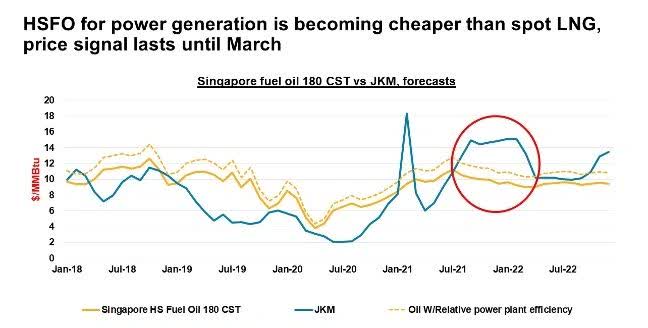

Several factors are increasing oil consumption. A post-pandemic economic reopening is underway, which is boosting travel demand as countries loosen restrictions, and likely to continue until exceeding prior levels. Additionally, the IEA estimates that coal-to-oil and natural gas-to-oil switching will likely increase crude demand by at least 0.5MM bbl/d, and send it past pre-pandemic highs to 99.6MM bbl/d by Q1 2022[1]. Structurally higher LNG prices are also likely to unlock pockets of oil processing capacity in Bangladesh and Pakistan, which are economically incentivized to restart idle oil-fired power plants:

Source: SP Platts

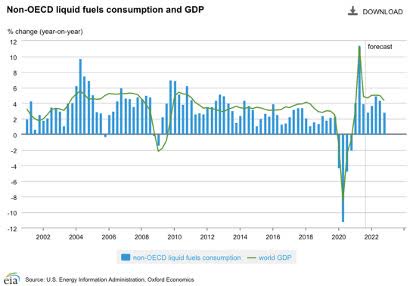

The trend of suburbanization may continue to be a persistent driver of oil demand, as families who have relocated during the pandemic get accustomed to their new, higher consumption lifestyles, and relocation trends continue. However, economic and population growth in emerging and frontier market countries will likely be the most important and largest driver of rising oil demand over time. Improving living standards beget higher oil consumption and shift the energy mix away from traditional biomass and coal to higher quality sources such as natural gas and oil:

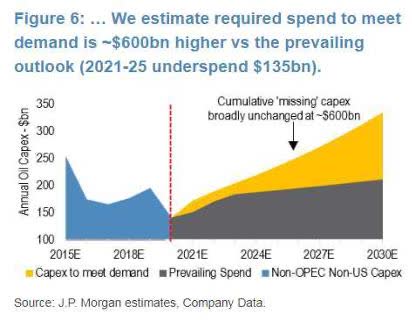

While the energy crisis may shift sentiment away from unreliable alternative energy sources towards more reliable fossil fuels, the short-term outlook for supply remains bleak. Years of underinvestment in the energy sector has withheld capital from many producers, particularly in the exploration of resource and delineation of reserves to replace current production. This may take years to recover from. J.P. Morgan estimates that an incremental $600B in capital expenditure is needed just to meet its base case for oil demand over the next decade:

OPEC Production Continues To Disappoint

Politicians, industry analysts and news reports continue to cite substantial OPEC+ spare capacity. Even U.S. President Joe Biden has called on the cartel to increase its production[1]. Yet, despite pleas from global leaders, OPEC+ production has languished, with all but 5 member countries missing their production quotas in September:

Bison has been early in voicing concerns about actual OPEC+ spare capacity, and now production issues have been surfacing. Although the cartel has collectively met its target monthly increase of 0.4MM bbl/d for September, it has missed this mark several times recently, including in August, when it was only able to increase production by 0.1MM bbl/d (75% below quota)[1]. Additionally, production increases have been driven by a few countries, with many smaller producers in the cartel failing to keep up – an early warning sign that their spare production may be topping out.

OPEC+ claims that they could surpass 2018 production levels to supply the same percent share of a growing oil market[2]. Bison remains skeptical given lower capital expenditures and drilling activity, large draws from onshore inventories, and recent production missing OPEC+ quotas. Instead, we produced a more reasonable estimate of true spare production capacity, based on market realities, which we outline below.

Procedure For Estimating Spare Capacity

We began by observing the trend for each member country between the month in which it reported its highest production level in 2018 and April 2020. We then projected this trend – expressed as an average monthly gain or decline in total production capacity – from April 2020 out until the end of September 2021.

2018 was the year in which many OPEC+ countries reported their highest ever production levels. It is useful as a “base” year because production has since declined precipitously for many members. April 2020 was a cut-off date because many members slashed production at the onset of the pandemic; including production numbers after this date would not be indicative of true voluntarily production.

We then subtracted the latest September production numbers from our estimate of total capacity, resulting in an estimate spare capacity for each OPEC+ country. Finally, the estimate for each country was “sanity checked” by using a mix of qualitative and quantitative processes. Our procedure is detailed below:

Findings: OPEC+ Spare Capacity Is Likely Overstated By 1.8 Million Barrels/Day

The IEA estimates that the OPEC+ cartel has 6.5MM bbl/d of spare capacity as of 2021, including quota-exempt Libya, Iran and Venezuela[1]. Bison estimates that the OPEC+ cartel has anywhere from 3.8MM – 5.2MM bbl/d, well below the IEA estimate:

While OPEC+ has some spare capacity, it is overstated in OPEC+ documents and IEA estimates. We also see that Iran may have approximately 1-1.5MM bbl/d of spare capacity, but its effect is uncertain as there is little visibility on when U.S. sanctions may be lifted or how much oil may already be on the market through undisclosed means. This means the bulk of the overstated spare capacity comes from the core OPEC 10 countries – specifically Saudi Arabia – which aligns with conclusions in Bison’s “The Myth of OPEC+ Space Capacity” white paper.

Model Validation

We used various measures to calculate and validate our estimate. For one, we factored some safeguards and conservatism into the estimation model itself. We checked for standard potential order of magnitude and bad data flaws such as greater estimated capacity than current production in a given country. We appropriately modeled countries that had no spare capacity based on flat-lined or declining production. And we applied a 15% margin of error to the output, which generates a range of values rather than a point estimate.

We are also using rig count data for each member country to sanity check spare capacity estimates. This rig activity corresponds with our estimates of changes in spare capacity. This data comes from different sources, and we are still verifying reliability of these and estimates. Feedback from former oil services executives who have operated in OPEC+ countries has been helpful. Based on what we have already validated for the core OPEC 10 countries, we observed that the rig count has declined by ~50% since 2018. This indicates that there has been a massive reduction of investment in this period, and supporting the estimate that OPEC+ total production capacity has declined.

Recent Developments Are Encouraging

Recently, ex Saudi Aramco EVP Sadad Al-Husseini said that the OPEC has no more than 2.5-3MM bbl/d of spare capacity. This falls in line with our estimate of 2MM-2.75MM for the OPEC 10 and is an external validation of the directional correctness of our estimate.

Additionally, the IEA has recently stated that rapidly falling spare capacity underscores the need for more investment in oil and gas infrastructure[1]. In June, they warned that OPEC+ spare capacity could fall to 5MM bbl/d, an estimate which they revised down from 4MM bbl/d in October[2]. As global oil demand rises and onshore inventories draw, we suspect that there may be further downward revisions in spare capacity estimates by IEA and other agencies – getting closer to Bison’s estimate.

Bison Takeaways

With less OPEC+ oil production spare capacity than claimed by OPEC+ and estimated by the IEA and others, the world oil supply is less certain and potentially closer to insufficient versus rising demand. With observed low elasticity of demand of oil consumption, a tighter oil market than consensus could result in much higher prices if supplies were to be disrupted or demand were to grow more than expected. Having seen this already with European and Asian natural gas and coal, and with a potential surge of oil demand for power generation this winter, the risk of an oil price shock is real and worth serious consideration.