European LNG imports reached a record high in January 2022 and could go a little higher if Russian pipeline gas supply falls, or even stops completely. But the best-connected European LNG terminals are already running at high rates, and limits to cross-border pipeline gas capacity would restrict the wider benefit of higher imports into some countries, such as Spain.

For LNG to take a much greater structural share of the European gas mix, additional import infrastructure is likely required, such as the renewed plans for German import terminals. Expansion of existing LNG terminals is another option.

The Dutch Gate and Belgian Zeebrugge terminals are to be expanded by 2024 and the Polish terminal in 2023. But neither of these options gives an immediate solution to any major shortage of gas and more capacity does not necessarily lead to more supply. Much of the LNG into Europe is supplied on a flexible basis and will flow to other parts of the world unless European prices are attractive.

One way around this is to sign contracts for firm LNG delivery which would guarantee volumes. But this may come at a premium price and limit buyer flexibility as and when European gas demand falls. All this is without considering the big role that Russian LNG into Europe has come to play alongside Russian pipe gas.

Europe’s LNG share

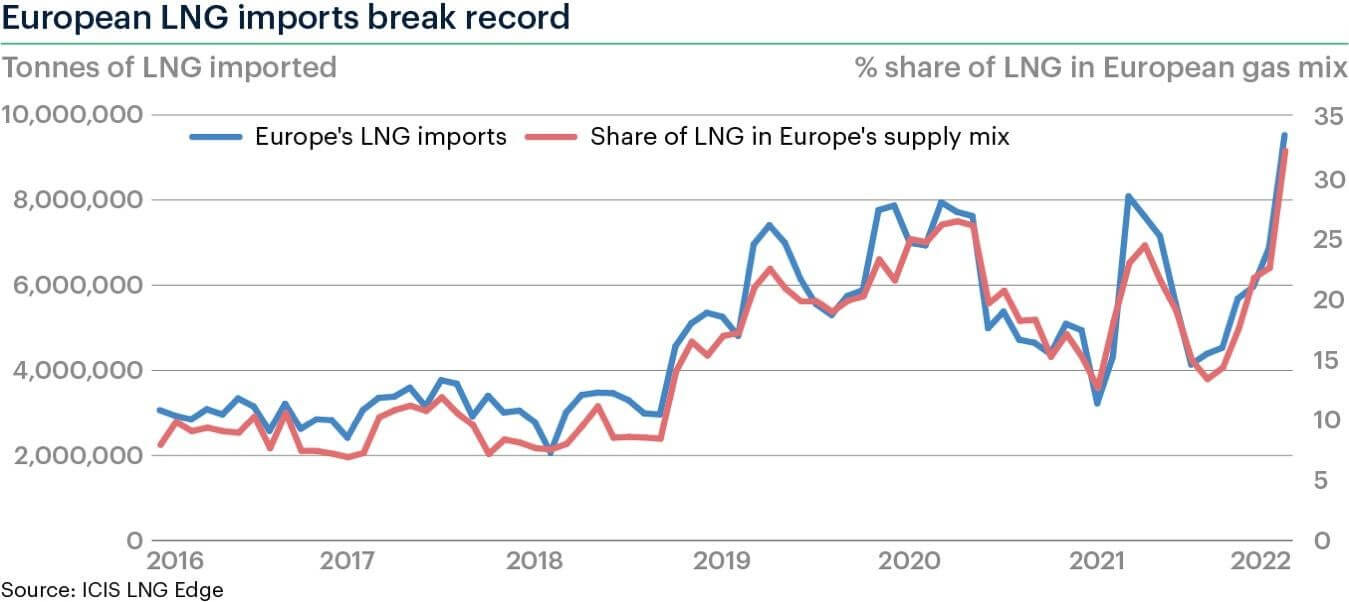

LNG’s share in the European gas supply mix has fluctuated widely in recent years, at times as low as seven percent, but in January 2022 reaching a record high of 32 percent. European LNG imports reached a record high of 9.53 million tonnes in January 2022, according to ICIS LNG Edge data.

February European LNG imports (as of February 28) are now the second highest ever in a month, at 8.14 million tonnes.

Terminal capacity

On the surface, there is plenty of capacity available to bring more LNG into Europe. European LNG terminal utilization, excluding Turkey, stands at 67 percent over the year to date, according to ICIS LNG Edge. While this is well below maximum rates, it is strongly up from the last 12-month average of 49 percent.

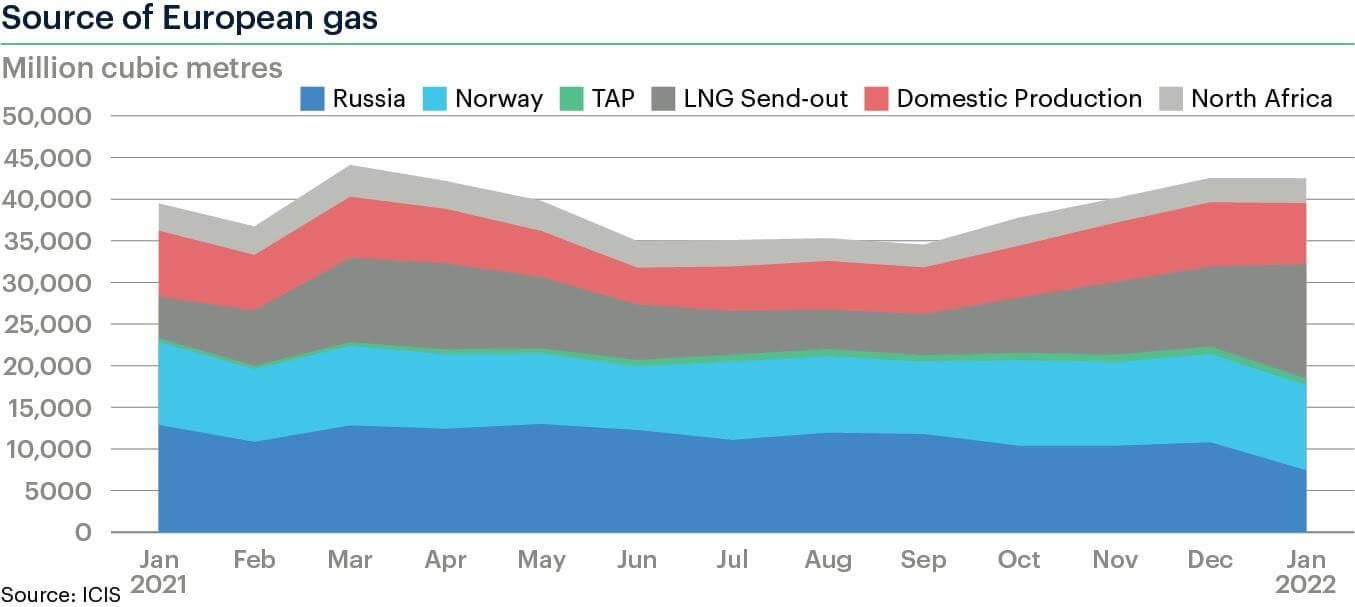

With lower Russian pipe gas in recent months, and high European gas prices, more LNG has come to European terminals, especially from the US. Total operational European LNG import capacity stands at just over 156 mtpa, which equals 13 million tonnes per month – almost 3.5 million tonnes (or 36 percent) more than was delivered in January.

A 100 percent LNG terminal utilization figure would have taken LNG’s share to 40 percent of the January European gas supply mix, if other supply remained unchanged.

In other words, even at maximum levels, it would not come close to replacing Russia’s pipe gas share. But 100 percent utilization will never be achieved. Several key import terminals in northwest Europe have already been running at maximum rates so far this year. These include the Dutch Gate, French Montoir, Belgian Zeebrugge and UK Dragon terminals, according to ICIS LNG Edge data.

Those that could bring in more LNG are in many cases not well connected to the broader European gas market, which would limit the benefit of additional LNG imports. Five of the terminals with the lowest utilization this year are in Spain, which has the largest LNG import capacity in Europe. Spain can only export pipeline gas to France. The maximum daily flow rate from Spain to France is 20 million cubic meters, which is typically about the daily maximum sendout from just one LNG terminal. So Spanish LNG does not have a major route into the higher gas demand centers of northwest Europe. However, Spain could hold more LNG in tank, which could then be reloaded and taken to other terminals in Europe.

Russian LNG

Within the LNG import figures, Russia now holds a greater share after the start of the Yamal LNG export plant in 2017. In 2021, Russian LNG was the third largest supplier into Europe, behind the US and Qatar. Just over 18 percent of Europe’s LNG was supplied from Yamal in 2021, according to ICIS LNG Edge. While Russian pipeline gas volumes have fallen, this has in effect been offset by strong Russian LNG. This again emphasizes the extent to which Russian energy is embedded in the European market.

Yamal LNG is majority owned by Russia’s Novatek. France’s Total Energies, China’s CNPC and Silk Road Fund also hold equity.

Qatar will expand its LNG production strongly in the 2020s, and new projects are expected to boost US LNG production, but global LNG production growth is limited in the next two-to-three years.