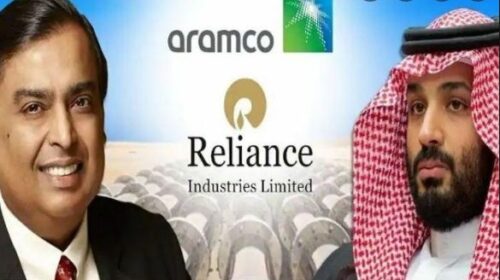

Saudi Aramco and Reliance Industries are abandoning a deal under which the Saudi oil giant was to buy a 20% stake in Reliance’s refining and chemical business, called Oil to Chemicals. The business has annual sales of about $43 billion, about a third of which is chemicals. In 2019, Aramco proposed to buy the stake for about $15 billion as part of a push to diversify its assets beyond oil and gas exploration in Saudi Arabia. But subsequent negotiations failed to yield a definitive pact. Reliance is also canceling plans to separate Oil to Chemicals into a stand-alone operation. The Indian conglomerate says a change in direction prompted it to reevaluate the combination with Aramco. Last year Reliance unveiled ambitious plans to have net-zero carbon emissions by 2035. And in September, Chairman Mukesh Ambani announced that Reliance was setting aside 2,000 hectares at its flagship refinery in Jamnagar, India, to build factories for photovoltaic modules, batteries, electrolyzers, and fuel cells.

Reliance, Aramco abandon deal