For the year as a whole, NEA had already declared in June that it was expecting at least 108 gigawatts of photovoltaic capacity to be added. This could almost double the record from 2021 with just under 55 gigawatts. Given the current nine-month additions, the restrictions imposed by the Zero Covid policy seem to jeopardize the achievement of the goal. In view of the complex market situation, AECEA continues to assume that between 80 and 90 gigawatts will be added in China in 2022. This would also be an increase of between 45 and 63 percent compared to the previous year.

It is noticeable that in China the new installations are increasingly moving in the direction of private and commercial systems. According to AECEA, they accounted for about 63 percent of the more than 30 gigawatts added in the first half of the year. But this is also intentional. The first provinces and administrative districts have already issued regulations for the use of photovoltaics on new public buildings and factories. In addition, there is a new pilot program by the NEA, which is intended to specifically promote the installation of roof systems. The first projects from the so-called “gigawatt bases” will probably only be realized by the end of next year.

While the NEA’s 14th five-year plan for the development of renewable energy from 2021 to 2025 does not contain a clear target for the expansion of photovoltaics, the plans of the provinces are more concrete in this regard, it says. According to this, 29 provinces have presented official expansion plans so far and are aiming for an increase of 390 gigawatts of photovoltaics by 2025. Not including the additions from 2021, this means a newly installed photovoltaic capacity of around 97 gigawatts a year by 2025. In addition to supporting photovoltaics at the national level also many provinces including the settlement of the solar industry. There is also an advantageous tax policy when it comes to “green” companies.

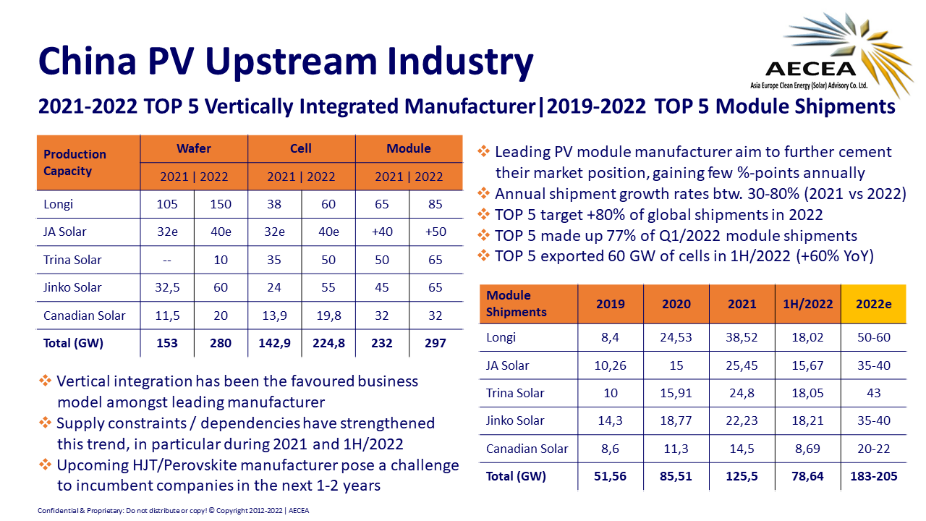

So it is hardly surprising that the Chinese photovoltaic market is very dynamic. This includes several new photovoltaic manufacturers focusing on topcon and heterojunction technology, but also increasingly using perovskite-based cell technologies. These advanced technologies are incorporated into numerous industrial policies at the national and provincial levels. Based on reports, AECEA states that expansion plans for Topcon exceed 220 GW total capacity and heterojunction is approaching 150 GW mark. However, it cannot be assumed that the industrial landscape in China will change fundamentally in the short term. The established photovoltaic manufacturers would consolidate their market position. Vertical integration remains the preferred business model, especially in times of supply bottlenecks. Many leading photovoltaic companies, including Trina Solar and Canadian Solar, have recently announced investments in silicon production.

The growth rates of the Chinese solar industry are quite impressive. By the end of September 2022, capacities for polysilicon, wafers, solar cells and modules had each grown by 50 percent year-on-year. In the first half of the year, the country’s ten leading module manufacturers had already delivered 100 gigawatts of modules and by the end of the year it will probably be 140 to 150 gigawatts. According to industry association CPIA, solar module exports have generated sales of $35 billion so far this year, up 110 percent from the same period last year.

Photovoltaic manufacturers are also continuing to work on a massive expansion of capacities along the value chain. The production capacities for polysilicon were up to 530,000 tons in 2021. According to the companies’ announcements, they are to be expanded to three to four million tons by 2024. A doubling is already planned for this year. In addition, the production capacities for wafers, cells and modules could each reach 550 to 600 gigawatts by the end of the year, as reported by AECEA.

But that’s not the end of it: 20 manufacturers have published their plans since January, according to which they want to expand module production by a total of 380 gigawatts. This should take place in the next few months, at most the next year and a half. New ten gigawatt factories are considered the “minimum”. The manufacturers who use new module technologies such as Topcon, where the majority of factories are built with two to three gigawatts, are a bit smaller.

But not everything goes according to plan in China, sometimes the weather gets in the way. Between June and August, the country went under a heat wave that swept almost all of China and also affected the output of photovoltaic manufacturers. The government in Beijing and many local governments have ordered production to be reduced or stopped for a certain period of time. In addition, there were several earthquakes in September, which briefly affected wafer production and caused prices to rise.