When the pandemic hit last year, it destroyed oil and gas stocks. But their prices have gradually been climbing and 2021 looks to offer a more prosperous outlook for the sector.

Many people see the death of oil as a welcome solution to combating climate change. But this is not a realistic view. We are hugely reliant on oil. Not just for heating our homes, running our cars, and delivering goods around the globe. Oil powers the modern industrial world.

Why do we need oil?

Oil is a vital ingredient in the manufacture of many refined products. A random selection includes everything from crayons and glue, to coatings for pills, plastics, cosmetics, clothing, construction materials, fertilisers and much more.The pandemic caused an immediate halt on demand for oil because it brought the entire travel industry to a standstill. And lockdowns in place meant less traffic on the roads. There is also massive pressure on governments globally to reduce their reliance on fossil fuels and move into more renewable alternatives. This is hugely important to meet the Paris accord.

The price of oil is rising

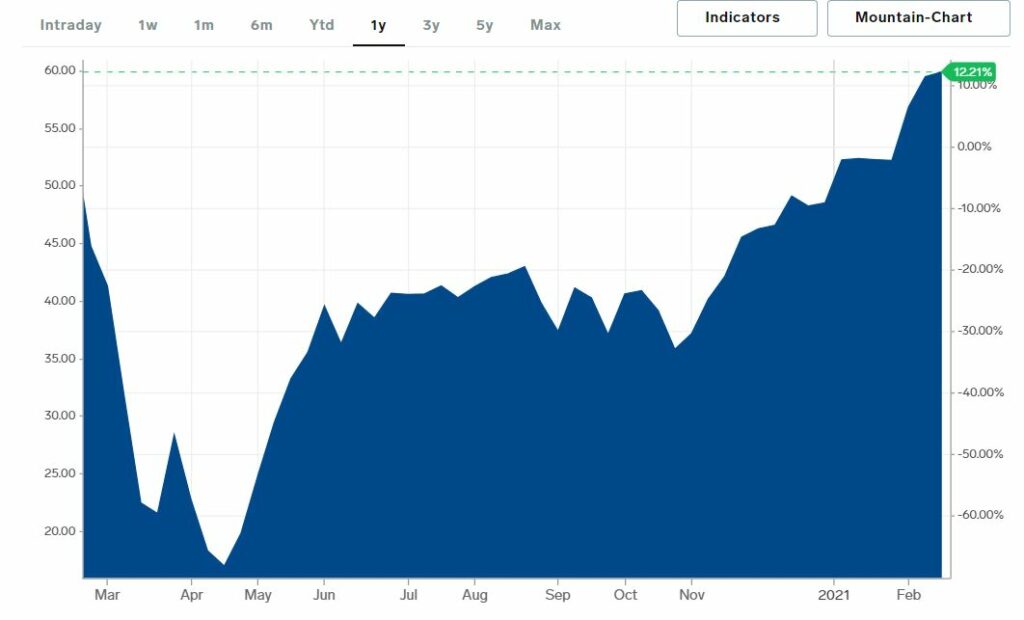

The price of oil has now recovered to its pre-pandemic levels, which is sending a signal of hope that life may be on route to normality. Both Brent Crude and West Texas Intermediate (WTI) are now over $60 a barrel. Meanwhile Natural Gas prices are soaring in response to a cold snap across the US.

It’s a very long way from the dark days of April 2020 when the pandemic ground global economies to a standstill and WTI bottomed out at just under $17.

There are several reasons. The vaccine rollout is well underway in many countries and Covid-19 infection rates are dropping, leading some to believe the worst is behind us.

While airline oil consumption has been crushed, there’s been an increase from the rise in ecommerce. This has driven demand from delivery trucks and manufacturers of plastic packaging.

Meanwhile, across Asia, things appear to be getting back on track and demand for oil is picking up here too. Asia, Africa & South America are all striving for a larger middle-class population, which will increase oil demand far into the future.

The oil price is also rising on hopes that the US stimulus will help invigorate the US economy. A less pleasant reason is from fighting in the Middle East where tensions are again rising.

The oil price is prone to volatility

The price of oil is notoriously volatile and rises on geopolitical tensions, of which there’s been no shortage in recent years. Before the pandemic hit, Saudi Arabia’s crude production was knocked out by a drone attack. Trump’s sanctions against China inflated oil prices and Trump also initiated sanctions on Russian state-owned Rosneft.

In 2019 Russia failed to comply with previously agreed Opec+ cuts, and in March 2020 Saudi and Russia both contributed to an oil price war that ultimately prolonged the oil price pain. Speculative reports believe Russia’s reluctance to comply with Opec+ was in retaliation to the sanctions on Rosneft but this was not confirmed.

Nevertheless, in April and June, OPEC+ did persuade the two nations to agree to further production cuts. This week Vladimir Putin has been in discussions with Saudi Crown Prince Mohammed bin Salman. They underscored their willingness to continue close coordination between Russia and Saudi Arabia in the interests of maintaining stability in the global energy market.