Rising fuel cost adjustments and limited energy diversification put Pakistani consumers at risk of escalating electricity bills. Here’s how the total tariff works and what to expect moving forward.

In a recent NEPRA hearing for September’s fuel cost adjustments (FCA), a case officer revealed a potential increase of ‘15 paisa per unit’ in the energy tariffs for XW-Wapda Distribution Companies (Discos) as a result of a negative 71 paisa FCA.

If approved, this could lead to higher electricity bills for consumers in November, and it would mean a month-on-month increased FCA of 17.4%, during which electricity generation fell by 5.2%. And a year-on-year decrease of 277.5% from last September, a period that saw a 6.4% decline in electricity generated.

While fuel prices globally have remained relatively stable compared to last year, this expected rise in energy tariff for consumers can be attributed to underlying structural issues in the FCA system, as well as the country’s lack of diversification of power sources.

- How is the total tariff calculated?

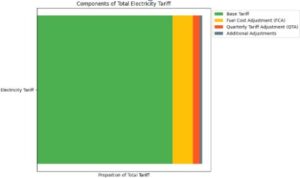

The total tariff consumers pay consists of three main components: the base tariff, the FCA, and the QTA. The sum of these represents the electricity bills shifted to consumers.

While consumers can partially manage costs by adjusting their electricity usage to control the base tariff, they have no control over fluctuations in FCA and QTA. These adjustments are driven by factors outside their reach, making electricity bills unpredictable and harder to budget for as these costs shift with fuel prices, operational inefficiencies, and regulatory adjustments.

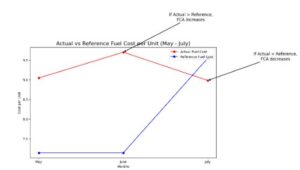

- FCA = Actual Fuel Cost – Reference Fuel Cost

Source: NEPRA

The FCA is the difference between actual fuel costs and NEPRA’s reference fuel costs. According to NEPRA, the actual increase or decrease in fuel cost prices has to be adjusted in ‘customers’ monthly bills’ in the form of FCA.

As such, the impact of September FCA will be seen in electricity bills for the month of November and this mechanism is meant to safeguard consumers from excessive rates, despite increased reliance on Hydropower which has no fuel cost.

Inefficiencies in Pakistani power plants account for a great deal of fuel price fluctuations, as it also accounts for fuel mix changes and fluctuating operational and maintenance costs which are reflected in these monthly adjustments.

Even transmission and distribution losses, which are typically accounted for in QTA’s, can impact fuel costs where inefficiencies in fuel usage impacts overall fuel requirement.

- How is QTA different?

While similar in practice to FCA, as it also impacts the total tariff, QTA’s are not affected by fuel costs, and instead account for changes in capacity payments, transmission losses, and variations in fuel prices that affect power purchasing.

The recent NEPRA hearing emphasized the potential QTA increase in Q1 of this fiscal year for Rs40-45 billion. However it was also mentioned that the next QTA will be offset as tariffs for Nuclear power plants have been revised and will result in a total negative QTA of Rs57 billion.

Provided that FCA remains steady, this negative QTA can also offset the net increase from FCA, potentially resulting in a net decrease in December, January and February electricity bills which will include QTA’s for Q1 of the current fiscal year.

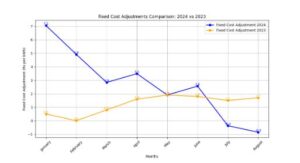

- So how does the proposed increase in FCA compare with previous figures?

Source: NEPRA

The figures for this year indicate increased volatility as FCA fluctuated from +Rs7.1 in January 2024 to -Rs0.9 (0.86 rounded up to the nearest 1dp) in August, with September’s FCA increase creating another upward trajectory, as it moved to -Rs0.71.

The difference between August’s FCA and September’s expected FCA of -0.71 shows a net increase of Rs 0.15 and indicates a shift of increased costs to consumers, which in this case are perceived as fuel cost fluctuations.

The above graph highlights a troubling trend: while international fuel costs have dropped, FCAs for Pakistani consumers have not consistently decreased, exposing them to unpredictable spikes in electricity bills.

This disconnect reveals underlying structural issues, inefficiencies within Pakistan’s power plants, a heavy reliance on costly backup sources like LNG and coal, and limited energy diversification, that force consumers to bear the brunt of rising tariffs.

Despite a broader global trend towards lower fuel prices, these factors mean that Pakistani households and businesses remain vulnerable to high energy costs, underscoring the urgent need for reform and diversification within the energy sector.

- What are the structural issues?

It was noted in the hearing that coal-fired power plants generated lower-than-expected power, despite contributing 19.3% of total generation. This shortfall made hydropower, which has no fuel cost, the primary energy source, accounting for 39% of total generation—a 1.5% increase from the previous year.

Nuclear power, though one of the lowest-cost sources, saw a reduction from 17% to 13%, impacting the cost balance within the energy mix.

The shutdown of the Neelum-Jhelum Hydropower Plant in May 2024, following a collapse in the headrace tunnel, compounded these challenges, reducing hydropower availability before its closure.

Without the plant’s steady, low-cost power, Pakistan had to rely more heavily on costly sources like coal and LNG to meet demand, putting pressure on both the FCA and QTA. This reliance on pricier fuel sources highlights the need for regular infrastructure maintenance and contingency planning to ensure energy stability.

Bagasse, used for energy production in some Independent Power Producers (IPPs), has further complicated tariff issues. Recent adjustments saw bagasse power tariffs spike from Rs5.98 per unit in July to Rs12.48 per unit in August.

The increase has sparked criticism as bagasse costs have now surpassed local coal rates, raising questions about fair pricing.

These structural issues underline the pressing need for diversified and resilient energy sources, as consumers bear the financial brunt of inefficiencies, limited resource diversity, and unpredictable operational costs.

In summary, the recent NEPRA hearings signal that Pakistani energy consumers may face higher tariffs in November due to ongoing FCA adjustments, and structural challenges in the energy sector which may also increase QTA for Q1.

The government’s attempts at diversification and improved pricing structures are crucial to stabilizing future tariffs, but until then, consumers will continue to bear the burden of an inefficient energy mix.