The COVID-19 pandemic is casting a shadow over the world of a possible economic recession which could be even worse than the one a decade ago, scholars said during the 2020 Tsinghua PBCSF Global Finance Forum held in Beijing on Saturday, calling for global approach and preparation for a long and bumpy recovery.

“I don’t think we are at the bottom,” Eric Maskin, 2007 Nobel laureate in economics, told CGTN in a video interview, noting the economy has been hit too hard for financial markets to stay high and, when the falling starts, there will be an adverse effect on real economy.

Considering the massive unemployment in the U.S. and the ongoing pandemic, the biggest financial impact is yet to come, he said in a keynote speech.

Economists at the forum agreed that the shadow of the pandemic will last long.

“As long as the pandemic is still spreading, there will be more damages to the economy,” Zhu Min, former deputy managing director of IMF and head of National Institute of Financial Research, Tsinghua University, said in a keynote speech.

It is unprecedented to see 30 million people unemployed in the U.S. in such a short time and it will be hard to get them back on jobs, he said, noting the economic recovery will be a long way since business profits will remain low and a series of bankruptcies is expected.

Compared with other countries, China has been in the process of reopening, however, the recovery will not be easy.

Like other modern economies, China depends greatly on international trade, therefore other countries’ sufferings will slow China’s recovery as well, said Maskin.

However, the fear of globalization is misplaced, he emphasized. “It would be a terrible shame if globalization moves backwards as a result of this crisis.”

Even if the supply chains were entirely national, they would still be interrupted in such a global pandemic, he said. “In fact, globalization can be an important way of getting us out of this crisis.”

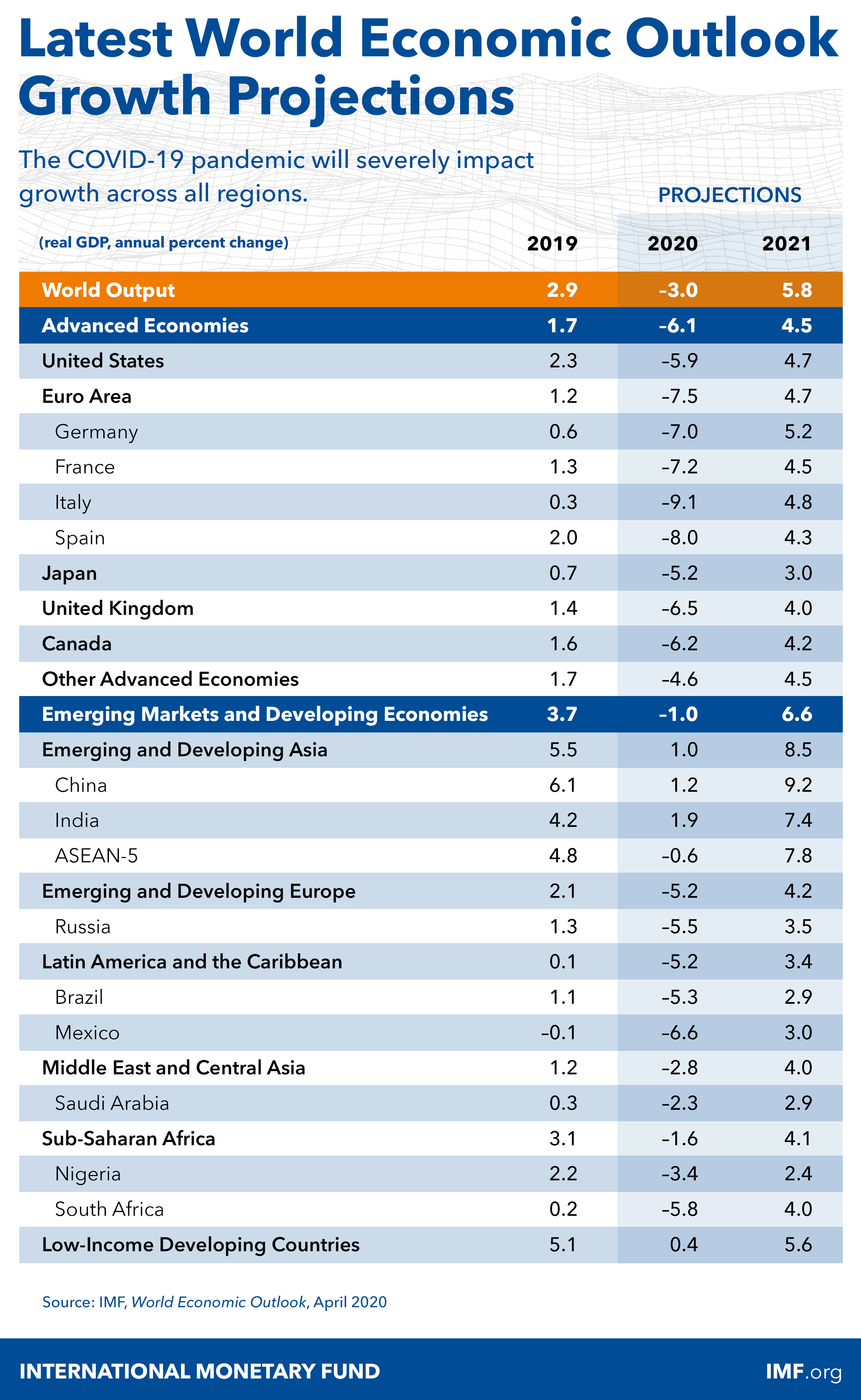

As a result of the pandemic, the global economy is projected to contract sharply by three percent in 2020, much worse than during the 2008–09 global financial crisis, according to IMF’s World Economic Outlook released in April.

Unlike the global economy shrinking, the IMF predicted that China’s economy will grow 1.2 percent in 2020, which Zhu described as a great achievement given the current circumstances.

/IMF

The recovery won’t be completed if people are not convinced that they are safe and aggressive monetary policies are maintained for a long time, Michael Spence, 2001 Nobel laureate in economics, said in his keynote speech.

“With the pandemic damaging the needs of the whole world, we have to prepare for a recession with a long bottom and multi rounds of risks,” Liu Guo’en, professor of economics at Peking University, said at the forum.

The virus outbreak also brought warnings to enterprises, especially small and medium enterprises (SMEs), said Tian Xuan, professor of finance at Tsinghua University.

Instead of empty talks about valuation or so-called lucrative chances, sustainable profits and cash are key to SMEs, Tian said, noting they should prepare for a long-term crisis.