When Saudi Arabia caused oil prices to tumble in March the impact on oil producers’ revenues was immediate. But in neighbouring Qatar, which is a leading producer of liquefied natural gas (LNG), the situation is more complicated.

Last year, LNG accounted for $45.3bn (62 percent) of Qatar’s $73.1bn in export revenues. LNG prices are linked to oil and have also plummeted since March, though with one crucial difference.

Qatar exports 77 million tonnes (MT) of LNG a year, but it sells just 6 MT of that on the spot markets for immediate delivery. Most of Qatar’s LNG revenues are tied up in medium and long-term contracts, with a time lag before any drop in oil price is felt by both sellers and buyers.

“Around about 85 percent of Qatar’s gas contracts are linked to oil, with a six-month delay, so in terms of fiscal impact it will only be felt in September. This is a problem, and there’s a debate as to what extent LNG volumes will be impacted,” said a senior member of a state-linked Qatari financial firm speaking on condition of anonymity.

“Saudi Arabia saw the impact [of the oil price drop] immediately, here we’re behind the curve.”

Spot LNG prices for delivery to North Asia, a key market for Qatari gas, in July reached an all-time low this year, dropping to $1.85 per million British thermal units (mmBtu). That is down by nearly three-quarters since October, from $6.80 per mmBtu, and down two-thirds on a year ago.

“Qatar has felt it on spot sales into Europe, getting around $1.6 mmBtu, and in Asia, just over $2 mmBtu, but the long-term contracts are still getting pretty strong prices, until around August,” said Andy Flower, an independent gas consultant.

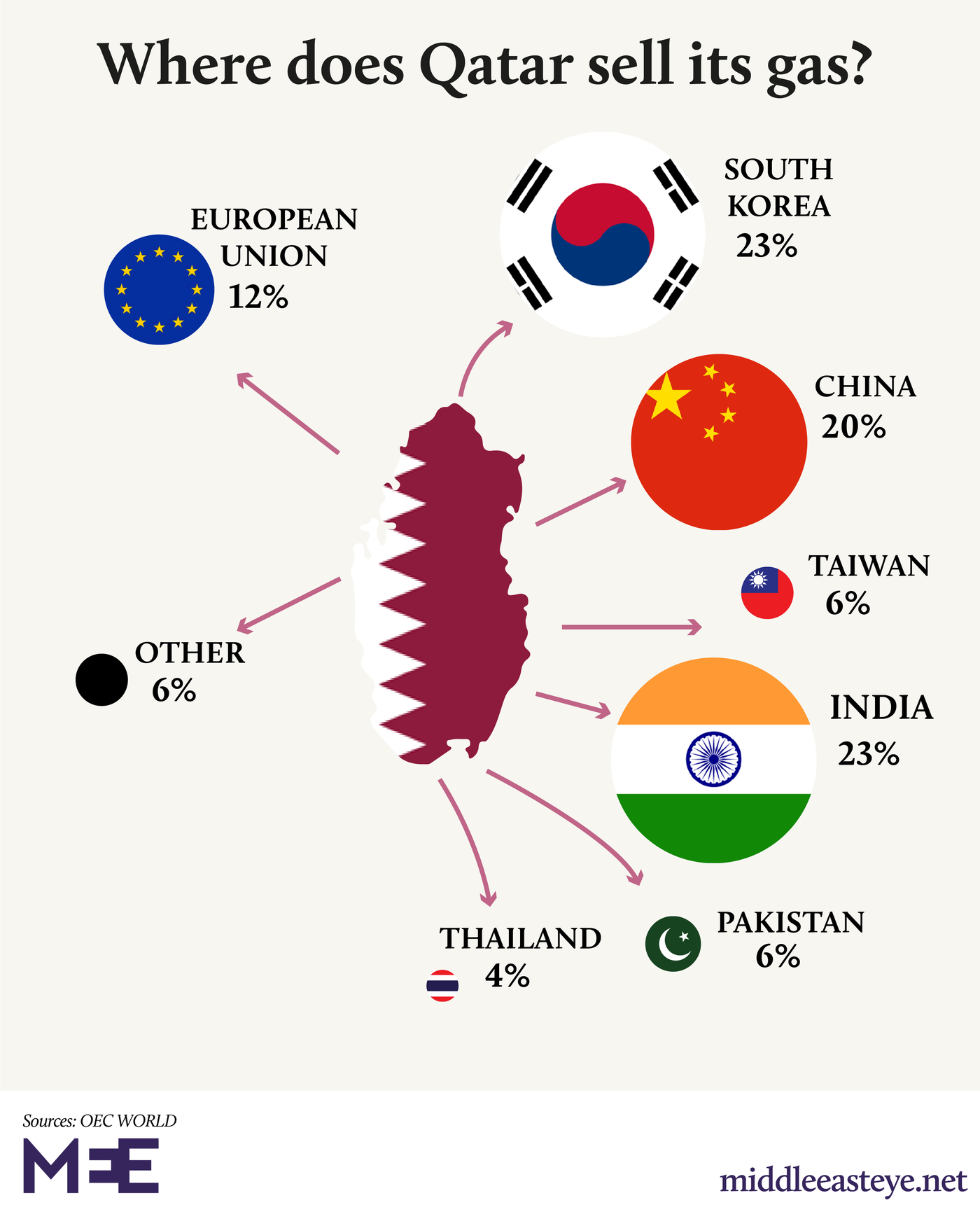

Last year, Qatar exported 48 MT of LNG to Asia, around 70 percent of its sales. In April, the price of Qatari LNG to Japan was still $10.12 per mmBtu, to South Korea $11.04, and to China $10.44, said Flower.

But with LNG spot prices slashed, buyers are renegotiating long-term contracts with Doha.

“There is no question renegotiations are happening. It might bring the impact forward from six months,” said the Qatari financial source.

Japan is seeking concessions for a contract that expires at the end of next year, and South Korea for a contract that ends in 2025.

“Buyers in Japan and Korea are looking for price reductions in negotiations to extend contracts that expire over the next five years,” said Flower.

‘The elephant in the room’

The impact of Covid-19 is set to see demand for natural gas fall by 4 percent this year, according to the International Energy Agency (IEA).

“The elephant in the room is not just the drop in price but also demand, which will depend on whether there is a second wave of Covid-19 or not. There is not quite as direct a link as Covid-19 and oil has been,” said Justin Dargin, an energy expert at Oxford University.

While oil prices have rebounded since March, with demand rising as economies open up with more transportation and industrial usage, natural gas demand has fewer uses, added Dargin.

It is primarily used for heating homes and businesses, for industrial energy needs, and transportation through compressed natural gas. Demand has risen in recent years as natural gas is considered to be cleaner than other fossil fuels.

The IEA has called the impact of Covid-19 on natural gas “unprecedented” – “the largest recorded annual decrease in consumption since the natural gas market developed at scale in the second half of the 20th century,” and “twice bigger than the latest downturn in 2009, when natural gas demand fell by two percent”.

With no V-shaped economic recovery expected, analysts forecast a 40 to 50 percent drop in prices from $12 mmBtu a year ago.

“In the second half of the year, revenues will go down. With the oil price back at around $40 a barrel, we’re looking at around $6.50 mmBtu for oil index priced LNG,” said Flower.

While Qatar can extract LNG for a dollar to $1.50 per mmBtu – among the lowest in the world – the drop in revenues will impact its already constrained budget.

Economic growth in 2019 was just 0.1 percent, and is forecast to contract by 3.5 percent this year, according to Deutsche Bank figures.

“Combining Covid-19 and low oil and gas prices with the preexisting conditions of sluggish growth and a boycott [since 2017, led by Saudi Arabia] is not a recipe for a robust Qatari economy,” said Robert Mogielnicki, a resident scholar at the Arab Gulf States Institute in Washington.

‘With all the talk of decarbonisation and zero emissions by 2050, you can understand Qatar being in a hurry’

– Andy Flower, independent gas consultant

The lower prices, renegotiated long-term contracts and lower demand may cause future LNG projects to be revised. In November, Qatar announced plans to increase capacity by 64 percent, to 110 MT per year by 2025, and to 126 MT/y by 2027.

“These long-term contracts are critical, as it’s not just about promising to buy, but also the loans that come with it for developing LNG infrastructure,” said David Roberts, an academic based at the Defence Studies Department, King’s College London.

“For once buyers have Qatar over a barrel. It will mean the terms are less and less favourable.”

To fund expansion, Qatar will need around $4 per mmBtu, said analysts, leaving the country a margin of a few dollars if prices remain low.

Qatar appears to have little option but to press ahead with exploiting the world’s third-largest gas reserves despite lower projected returns, with the window closing on a return on investment for the massive expansion.

“With all the talk of decarbonisation and zero emissions by 2050, you can understand Qatar being in a hurry. If the second phase comes out in 2027, and you need 20 years to fully pay back the investment, you’re already at 2047, so if they don’t do it now, will they ever get a chance?” said Flower.

‘Full steam ahead’

While Qatar Petroleum (QP), the state-owned oil and gas company, announced a 30 percent reduction in expenditure in May, it also announced it is “full steam ahead, we’re going to expand”.

Qatar’s gas sector is dominated by QP and its subsidiaries Qatargas and RasGas, which are joint ventures with global energy players including ExxonMobil, BP, Total and ConocoPhillips.

To cater to a trebling of LNG capacity, in June, QP announced orders of $2.86bn with China and $19bn with South Korea to build up to 100 LNG supertankers, with energy minister and QP chief executive Saad Sherida Al-Kaabi describing the deals as the “largest LNG shipbuilding programme in history”.

So far only 60 firm orders have been placed, however, with the remainder optional.

“It is a little misleading, to make the deals sound a lot more attractive than they really are, but it all makes for good headlines,” said Flower.

The supertankers, carrying LNG cooled to -162 Celsius, will allow Qatar to be more flexible in its selling operations as market conditions shift, and to favour spot prices over longer-term contracts. Ships can change course to where a market needs it, and store excess capacity if demand falters.

The expansion of LNG production will retain Qatar’s position as the world’s largest exporter, seeing off rising competition from Australia, US shale gas producers, and others that have ramped up production in recent years.Oil price turmoil: How Saudi Arabia’s $100bn gambit could backfireRead More »

Such plans parallel Riyadh’s move in March of upping oil production to gain market share and squeeze out higher-cost producers.

“Qatar is trying to set itself up as the Saudi Arabia of gas,” said the Qatari financial source.

Just as Saudi Arabia’s Public Investment Fund (PIF) has acquired stakes in oil companies this year, Qatar Petroleum has also solidified its presence abroad through investing in LNG projects in the Ivory Coast and Mexico, and retaining its commitment to the $10bn Golden Pass LNG export terminal in the US state of Texas.

“Qatar is buying out the competition. Its view is that because it has one of the lowest costs it can ride out this storm, while higher-cost producers will not. It is seeking to leave Australia in the dust, and not too far back in their mind, to cut US production,” said Dargin.

Qatar may also deepen ties with Russia, another gas giant, to coordinate gas policy after signing an agreement in December, which mirrors Riyadh and Moscow’s coordination on oil production cuts through the OPEC+ agreement in April.

“There is the possibility, much like OPEC+, that if the low gas price environment is sustained, it could draw Russia and Qatar together to coordinate policy,” said Dargin.

Only as LNG price figures for earlier this year are released, month by month, will Qatar have a firmer idea of how strong a hand – and wallet – it has to play while wearing the LNG crown.

“The next three months will be fascinating,” said the Qatari source.