Having been the apex body of cement makers for the last 12 years, the All Pakistan Cement Manufacturers’ Association (APCMA) knew well that when the regulator comes calling, it is rarely to convey good news.

Last week, the Competition Commission of Pakistan (CCP) conducted a search at the headquarters of APCMA in Lahore purportedly to gather evidence of possible communication, arrangement, agreement or understanding among cement producers pertaining to the alleged violation of the provisions of Competition Act 2010.

A week later, there is no knowing what came to pass and if the CCP could dig evidence of any misdeed by the concrete producers. The are no reports as to what made the watchdog stop right in its tracks, which appears to have been the case. But any student of accountancy would tell you that to establish the fairness or otherwise of the pricing of a product, it must be matched with its cost of production — something that could.

In a policy note to the government on May 8, the CCP recommended that the Securities and Exchange Commission of Pakistan (SECP) should reinstate the requirement of cost audit for cement, sugar, vegetable ghee/cooking oil, fertiliser and wheat flour industries besides any other sector when and where deemed necessary for the purpose of facilitating policy interventions in a fair, transparent and independent manner.

The commission is of the view that any limitation placed on cost audits may promote anti-competitive practices that in their very essence are detrimental to public interest,” the policy note said. Under Section 258 of Companies Ordinance 1984, the federal government had the powers to direct companies to carry out audit of their cost accounts. Typical industries in this regard included fertiliser, thermal energy, petroleum refining, natural gas and polyester fibre, sugar, cement, vegetable ghee and pharmaceutical sectors. However, in Companies Act 2017 that replaced the earlier ordinance of 1984, “the requirement of issuing a general or special order in this regard (cost accounting) has been omitted,” the CCP policy note pointed out.

While the SECP had the unconditional power to direct companies to carry out the audit of their cost accounts, it could only be exercised “subject to (the) recommendation made by the regulator of the relevant sector or an entity therein”.

CCP Chairperson Rahat Kaunain Hassan told this writer that it was beyond comprehension why for the purpose of cost audit such a specific requirement or precondition of recommendation from a “regulatory authority supervising the business of (the) relevant sector or any entity of the sector” was introduced in Companies Act 2017 when none of such sectors — sugar, cement, fertiliser, ghee, cooking oil and wheat — currently has, or used to have, any supervising sectoral regulator.

She said that the CCP’s policy note recommended reinstating the practice of conducting the cost audit of a class of companies and it was of public importance. “Once the former provision that existed under Companies Ordinance 1984 is restored, it will not only facilitate access to reliable third-party certified data but also help in enforcement measures and curbing and preventing harmful anti-competitive practices.

In this regard, the role of the Ministry of Industries and Production has also been supportive as it endorsed our recommendation, Ms Kaunain said while referring to a letter written to the SECP by the minister of industries and production on June 16 that said: “This division endorses the viewpoint of the CCP and requests the SECP for the reinstatement of cost audit as recommended by the CCP in its policy note.”

The CCP chairperson said the SECP had pursuant to its recently proposed regulation now required specified sectors like cement, sugar, ghee, cooking oil, wheat and fertiliser to maintain the particulars of cost account records and prepare cost statements. In its policy note, the CCP observed that almost all the sectors that have historically been required by the SECP to carry out the cost audit of accounts, under Companies Ordinance 1984 do not have a sector-specific regulator, thus making the provision for directing the cost audit under Companies Act 2017 ineffectual for all practical purposes. Various government bodies that require readily available and credible cost information have to rely on industry players or their associations instead of an independent third party with no inherent conflict of interest.

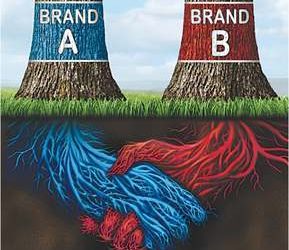

Not only could this negatively impact government decisions, but also public interest at large. The absence of audited cost accounts in any sector and the reliance on industry associations for information could lead to an exchange of commercially sensitive information at the association’s platform, impacting competition and hurting consumer welfare.

In putting such reliance, not only does the government inadvertently legitimises such exchange at the association’s level, but also risk the usage of an association’s platform to enter into prohibited agreements, such as price fixing, a behaviour universally considered to be very harmful to competition, and against public interest, the policy note stated.

Following the June 16 directives of the Ministry of Industries and Production, the SECP on Sept 21 released for public comments a draft Companies (Audit of Cost Accounts) Regulations 2020. The essence of the regulations is contained in the initial sections whereby it is stated: “Every company engaged in production, processing, manufacturing or mining activities is required to maintain particulars relating to utilisation of material or labour or the other inputs or items of cost under first proviso to sub-section (1) of section 220 of the Act.”

The upcoming proposed regulations stipulate that every company will keep cost accounting records in such a way as to make it possible to calculate from the particulars entered therein the cost of production and cost of sales of each of the products separately during a financial year. The regulation proposes that they are to be complied in the same manner as required for financial accounts required under Section 220 of the said Act. Every company will be required to get their cost accounts audited by cost auditors who would be qualified chartered accountants.

Ms Kaunain said that while the CCP will review and revert with its comments on the proposed regulation placed on the website for public comments on Sept 21, it needs to be appreciated that previously the SECP had the unconditional power to direct the carrying out of the audit of cost accounts (of such companies) in terms of Section 258 of Companies Ordinance 1984. Most of these sectors in the past have either been found or suspected of carrying out anticompetitive practices. “Therefore, anomaly is not yet fully resolved through the proposed regulations, the said unconditional power of the SECP must also be restored through an amendment in the subsection (2) of section 250 of Companies Act 2017 in unambiguous terms,” the anti-monopoly body chief said.